Articles

Gain deeper insight with articles that give our considered opinion and predictions of where the industry will go next.

Announcing the Tax Compliance Toolkit Training Academy

We are delighted to officially announce the launch of the Tax Compliance Toolkit Training Academy with our debut course: QI Essentials.

This course provides a foundation level understanding of the U.S. qualified intermediary regime and the role you play in helping your firm to be compliant with the terms of the QI Agreement. Find out how you can access the training...

The New QI Agreement 2023: What it means for you (Webinar Recording)

A new QI Agreement is due to be released in January 2023, including new obligations for qualified intermediaries that allow their clients to own interests in publicly traded partnerships.

We hosted a webinar on 8th December for financial institutions in Taiwan and Hong Kong to explain the implications of these proposed changes. Watch the recording now...

Saudi Arabia KYC Rule Approval: What it means for you (Webinar Recording)

Saudi Arabia’s KYC rules were approved by the IRS earlier this year, which means that all Saudi Arabian financial institutions are now eligible to apply for QI status.

We hosted a webinar on 30th November for financial institutions in Saudi Arabia to explain the benefits of becoming a QI. Watch the recording now...

Periodic Review and Certification: QIs in Taiwan Take Note

Many financial institutions in Taiwan became qualified intermediaries in 2018 and 2019 and are now approaching their first periodic review.

Find out what you need to consider when selecting a reviewer…

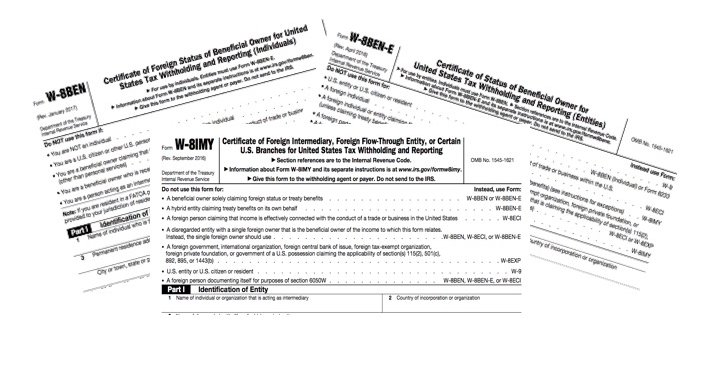

3 Big Problems with US Tax Regulations

We explore some of the problems we have encountered surrounding the use of Form W-8BEN-E by brokerages and issuers of equity linked instruments.

Benefits of Being a US Qualified Intermediary: Malta Stock Exchange

TConsult is delighted to announce that we have been invited to present a training course for the Malta Stock Exchange, where we will be delivering a two hour presentation discussing the benefits of being a US qualified intermediary at 9am on Monday 21st January 2019.

Nationality, domicile, residency, citizenship and beneficial ownership

We often find that linguistic issues can cause problems for firms looking to establish the correct withholding rate for their clients. In particular, we have seen the distinctions between nationality, citizenship, domicile, residency and beneficial ownership cause a degree of avoidable consternation. In this post, we present a quick reference guide.

Your ‘Bible’ to Compliance

The road to compliance is never ending and the IRS have certainly given us some interesting scenery to admire as we traverse the QI regulatory landscape.

In this post we discuss the importance of a living compliance program, and highlight some of the IRS announcements that need to be reflected in your policies and procedures if you want to remain fully compliant.

GATCA: A Practical Guide to Global Anti-Tax Evasion Frameworks

December 8, 2017TConsult's subject matter experts Ross McGill, Chris Haye and Stuart Lipo have written a new book providing a practical guide to global anti-tax evasion frameworks. In this post, Stuart describes the context for the book...Read more

Are FATCA’s Dissenters Tilting at Windmills?

November 8, 2017Like Don Quixote, FATCA’s dissenters may have misidentified their enemy. So what is the problem with FATCA and what might happen if the anti-FATCA movement succeed in getting it repealed?Read more

The Challenges of GATCA

November 8, 2017The global anti-tax evasion frameworks that comprise GATCA have as many commonalities as they have differences, so it makes sense to approach regulatory compliance in a holistic fashion. In this post, we explore how smaller firms are responding to the pressures of compliance...Read more

FATCA Misconceptions

November 8, 2017For some within the industry, the mere mention of ‘FATCA’ is enough to spark compliance-nightmare flashbacks. The ever unpopular FATCA regulations have now been with us for seven years. But, despite its relative longevity, there are a surprising number of misconceptions surrounding FATCA....Read more

Will AEoI be the new Equifax?

September 19, 2017What are the data security risks associated with the AEoI framework? In this post, Ross McGill explores some of the risks and issues a stark warning to the financial services industry.Read more

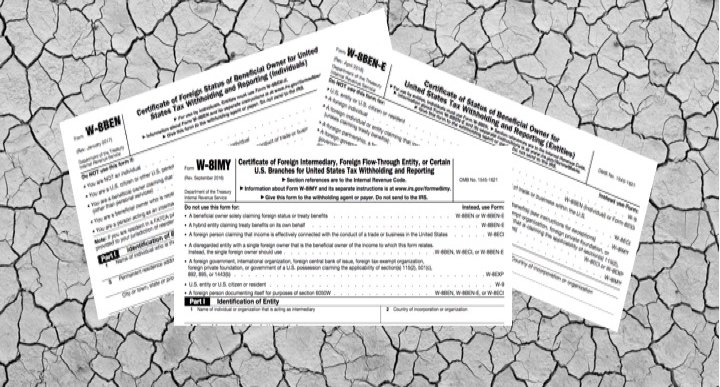

Why W8? – Start re-papering over the cracks now!

September 13, 2017QIs and NQIs face a rare opportunity to dramatically increase their W-8 compliance rate by re-papering all existing clients using the IRS' new W-8 forms. Find out how such a project could benefit your firm and why it could be worth it in the long run.Read more

3 Things To Annoy You About W-8s and 3 Things You’ll Love

July 31, 2017The IRS just made three HUGE changes to W-8 series of self certification forms used by almost every financial institution across the globe to categorise their non-US customers, and there's a lot to love...Read more

Remember your New Reporting Obligations Under AEoI / CRS

May 31, 2017You're just getting over the initial FATCA and QI reporting, submitted all of your 1042-S forms, and now you're looking ahead to September and the deadline for all those 1042 forms. However, you may need to report under AEoI/CRS at the same time. Are you planning ahead to avoid this headache?Read more