Ross McGill

Your W-8 Questions Answered

In our last blog about W-8 forms, we talked a bit about what they are and what they’re used for. We got a lot of questions about W-8 forms off the back of that post, so today I thought it would be a good idea to gather some of them together and answer them. I promise I’ll do my best to not answer each one with ‘it depends’!

If you need an update on the basics of a W-8, click here to read the last article. Otherwise, let’s get into it.

Who Needs to Complete W-8 Forms?

Any non-US investor trying to open an account with a broker or a custodian bank will almost certainly be asked to provide a W-8 (or a W-9 if they’re American). The institution will ask you to fill one in or collect the information they need from their website (called a substitute W-8).

Which Countries Have Double Tax Treaties with The US?

This is a tricky one because double-tax treaties are changing all the time. However, I can tell you that at the time of writing, there are approximately 65 countries that have a tax treaty with the US. Get ready for a long list, because that includes:

- Armenia

- Australia

- Austria

- Azerbaijan

- Bangladesh

- Barbados

- Belarus

- Bulgaria

- Canada

- Chile

- China

- Cyprus

- Czech Republic

- Denmark

- Egypt

- Estonia

- Finland

- France

- Georgia

- Germany

- Greece

- Iceland

- India

- Indonesia

- Ireland

- Israel

- Italy

- Jamaica

- Japan

- Kazakhstan

- Korea

- Kyrgyzstan

- Latvia

- Lithuania

- Luxembourg

- Malta

- Mexico

- Moldova

- Morocco

- Netherlands

- New Zealand

- Norway

- Pakistan

- Philippines

- Poland

- Portugal

- Romania

- Russia

- Slovak Republic

- Slovenia

- South Africa

- Spain

- Sri Lanka

- Sweden

- Switzerland

- Tajikistan

- Thailand

- Trinidad

- Tunisia

- Turkey

- Turkmenistan

- Ukraine

- Venezuela

- United Kingdom

- Uzbekistan

When And Where to Submit Your W-8

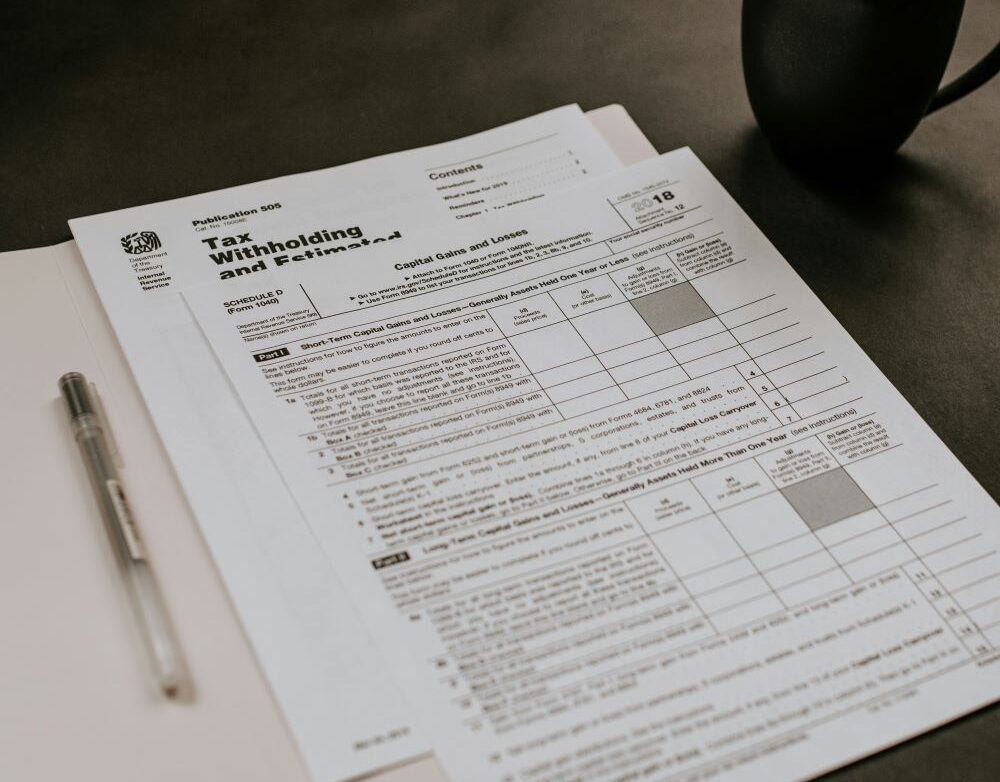

No one submits their W-8 or W-8BENEs directly to the IRS. Instead, you send them back to the institution that requested it. They will then be used by the institution to decide whether to let you open an account, how to treat and tax US investment income paid to your account and whether your account is reportable under US anti-tax evasion regulations.

What’s The Difference Between W-8 And W-9 Forms?

Just to add in another issue, there’s also a W-9 form. Thankfully, it’s easy to differentiate the two.

W-8 forms are for non-residents of the US only. That includes international students, who will need to file a W-8BEN where necessary.

W-9 forms are for citizens and residents of the US. So if you’re a US resident for tax purposes, then you’ll need to provide a W-9.

How Long is a W-8BEN Valid For?

It does depend (sorry).

Provided none of the details on the form change, your W-8BEN will be valid for three calendar years from the end of the year in which you sign it. So, if you completed the form on the 28th of March 2024, it will be valid until the 31st of December 2027.

There is another quirk of the system, but it shouldn’t affect you. Your financial institution is collecting these W-8s to document your tax status under two different “chapters” of the US Internal Revenue Code – Chapter 3 and Chapter 4. The quirk is that if your financial institution is only collecting the W-8 solely to document your Chapter 4 status, then the form is valid indefinitely or until you have a change in circumstances. The three-year validity rule only applies if you’re expecting to receive US investment income into your account, so the financial institution needs to know your Chapter 3 status too.

What’s The Difference Between a W-8BEN and a W-8BENE?

There are a few differences between the W-8BEN and the W-8BENE. The main one is that the W-8BENE is the form for ‘entities’, meaning any type of business or other type of institution that has more than one owner. That could be a corporation, certain types of partnership or trust, exempt entity, public and private foundations, international organisations and even foreign governments.

The default US tax rate for income received by foreign businesses is 30%, but this form will allow the business to receive a tax treaty reduction if it’s applicable and if it’s properly claimed on the form. In particular, the entity has to make a certification on the form to show that it meets what is called the limitation on benefits test.

The W-8BEN on the other hand, applies to income paid to individuals. So while the outcome is similar, the forms are aimed at different categories of people and types of account holders.

We went over these differences in more detail here.

What Happens If I Fill in the Form Incorrectly?

There are estimated to be around 900 million W-8s in circulation and about 30% are completed incorrectly in Europe. That failure rate rises to about 70% in Asia. That’s because it’s an American tax form, it’s not simple and it’s not written in plain English. Differences in language, culture and levels of understanding can affect whether you understand what you’re signing.

The big thing to recognise is that the form is signed under penalty of perjury. This means that if you fill the form in incorrectly, whether that’s deliberate or accidental, and your financial institution taxes your US income at the wrong rate, you’re the one on the hook for liability, not them.

In the end, most financial institutions are very conservative. If there is any doubt, they will tax at the maximum rate of 30%. That means that you may be over-taxed through no fault of your own. In such cases, if your financial institution is a qualified intermediary (QI), then you can ask them for a refund because their contractual agreement with the IRS obligates them to do so. If they are not a QI, then you can, in theory, file a claim directly to the IRS for a refund. The process is not simple or quick and you’ll need to ask your financial institution for a form 1042-S to prove that they over-taxed you. Then, if you’re an individual, you can file a claim on a form 1040-NR together with your 1042-S (and other supporting evidence). If you’re filing a reclaim request for an entity that was over-taxed, the form will be an 1120-F.

Who Can Help Me?

Us! At TConsult we have over 20 years’ experience in the financial services industry, particularly dealing with US withholding tax and all that comes with it. Our subject matter experts have detailed knowledge of the governments and financial institutions in over twenty-seven countries, making us perfectly placed to handle your W-8 questions and support you through the process.

We created an online platform for W-8 forms to be used by financial institutions. So, if you work for a financial institution that provides access to the US securities markets, you should get a demonstration of our Investor Self-Declaration (ISD) system. This collects all the required information for a substitute of all the W-8 forms or W-9 and makes sure that you don’t make any mistakes.

If you would like to know more, or if you’re a financial institution struggling with compliance, or you have questions about a W-8, W-8BEN or W-8BENE, just get in touch with one of our experts today.

Articles

Gain deeper insight with articles that give our considered opinion and predictions of where the industry will go next.

The FASTER Directive Is Coming Up Fast – Are You Ready?

April 4, 2024By now, many of you should have heard about a new proposed EU Directive called FASTER. It stands for Faster […]Read more

W-8 – W-8驗證的險境

April 2, 2024美國的稅收制度是世界上最大的制度之一,意味著其變動將會對更廣大的市場帶來連鎖反應。FATCA是近期史上最大的變革之一,且對其他稅務市場的運作造成許多根本性的改變。特別是,確保金融機構需要使用一些美國W-8系列表單來收集客戶的FATCA(美國稅務)狀態訊息。 W-8系列表單是美國國稅局(IRS)不定時更新的紙本表單,有以下幾種類型: W-8BEN 給個人使用 W-8BENE 給實體與某些類型的信託使用 W-8ECI 給與美國商業貿易有效連結所得的客戶使用 W-8EXP 給政府或國際機構客戶使用 W-8IMY 給中介機構或某些類型的稅務透明信託使用 W-8表單為IRS做了一些事,任何時候有大約9億份W-8表單在流通。它們都有一個共通點 – 需要被驗證。 W-8有什麼作用 W-8表單涉及美國國內稅收法(或IRC) – 第4章(FATCA)與第3章(QI/NQI). 我特別按次順序說明,因為那是IRS法規要求遵循的盡職調查與驗證法規。這兩章都有對支付給客戶的美國來源FDAP所得課徵稅款的可能性。在第4章中稅率是30%,而第3章下稅率為30%或較低的租稅優惠協定稅率。這些法規基於非重複徵稅原則(亦即,如果第4章中有預扣稅款,則第三章無需預扣稅)。如果在第4章沒有需要預扣的稅款,那麼在第3章中的預扣稅款則依據W-8所聲明的正確稅率預扣 […]Read more

US Reporting Tax – How Does It All Work?

March 28, 2024As we get to the end of March, most of you will probably be fussing over your reporting obligations and […]Read more

The W-8 Web – Perils OF W-8 Validation

March 15, 2024The US tax system is one of the biggest in the world, which of course means that changes will have […]Read more

There Might Be A Problem With Your TCC – And You Need To Act Now

March 12, 2024Now that we’ve all relaxed after the IRS notification that electronic filings of US tax returns (Form 1042) have been […]Read more

定期審查認證–入門指南

February 29, 2024在我上一篇關於定期審查的文章之後,一些人詢問了有關向IRS提交的認證類型的問題–正是定期審查的結果。在上一篇文章中,我解釋了QI的責任長官必須如何透過獨立顧問(或具有QI稱職能力的內部審計員)進行定期審查,以對其遵守QI協議的情況進行適當監督。所有這些都是QI協議中規定的控制、監管和執行制度的一部份。 每一個QI協議週期為6年,分為兩個「認證期」,每個認證期為3年。每個認證期定義了3年的時間區間,責任長官將選擇其中一年進行定期審查。審查完成後,責任長官需要添加他們所掌握的有關公司合規性的任何資訊。這包含教育訓練記錄、系統審計和業務變更管理程序等–這些都不包括在定期審查中。屆時,您可以決定需要提交哪種類型的認證。 兩種類型的認證 一旦定期審查完成後,您需要向IRS提交一份認證。您可以提交兩種類型的認證: 有效控制認證:這是有效控制的完整認證。它本質上是說「這裡沒有任何問題!」並且所有內容都已經過審查並發現一切正常。 合格認證:如果審查員發現您的組織內存在尚未修復的重大缺失或違約事件,那麼您就需要提交合格認證。我稍後會解釋這兩者的含義。 這兩項認證都是通過IRS QAAMs網站提交和處理。當您提交報告時,您將在方框內打勾,證明您遵守了QI協議的特定部份。 提交事實資訊 在提交認證的同時,您還需要上傳「事實資訊」。這是責任長官必須收集並向IRS報告的一組詳細資料。一旦您收到定期審查報告,他們就需要這樣做,並找出兩種特定類型的問題–重大缺失和違約事件。 這樣做的目的是,如果QI確實採取了有效的控制措施(他們也應該這樣做),那麼他們就會在審查員拿到資料之前發現任何問題並加以解決。雖然完美的合規是理想目標,但我們都是人,都會犯錯。IRS也體認到這一點,機構時常會出現問題。認證期間和定期審查的目的是獨立確保責任長官確實實施了有效的控制措施。 重大缺失與違約事件 在事實資訊報告中,您將需要納入任何重大缺失和違約事件。但只有在定期審查前尚未修復的情況下,它們才會對您提交的認證類型產生影響。因此,如果審查員發現或您向他們揭露了尚未修復的重大缺失或違約事件,那麼您就必須提交「合格認證」。這實質上是告訴IRS您沒有有效的控制措施妥善管理您的合約義務。這可不是什麼好消息。 重大缺失和違約事件都是QI協議中定義的術語。您可能很久沒有讀過這份合約了,所以我們給您一個提示–關於重大缺失,請參閱第10.03(B)條;如果您想梳理其中的內容,請參閱第11.06(A)-(S)條。我們希望每個QI都能在其書面QI合規計劃中納入保護性控制措施(這也是QI協議第10.01條中的規定)。這就回答了「我如何確認這個缺失不會發生,如果發生了,我如何知道?」的問題。 同樣重要的是,重大缺失的定義僅限於「QI的員工或長官為避免或規避QI協議中的義務而蓄意採取的行為」。在大多數情況下,這是一個相當高的標準–責任長官除外,因為他們應該對協議瞭若指掌。 如果您提交合格認證會發生什麼事? 如果您確實需要提交合格認證,您需要向IRS提供一份補救計劃,詳細說明您將如何以及何時解決問題,同時提供一份您作為責任長官將解決問題的證明。 IRS將審查您的計劃,並且他們可能會立即同意您的計劃。他們可能會提出修改建議,甚至要求您制定不同的計劃。或者,他們可能會堅持對您的補救措施進行一些監管。顯然,IRS希望每個人都能遵守規定,如果您願意糾正問題,IRS會與您合作。但要注意。曾有QIs因不合規而被取消QI資格的案例,這通常是在定期審查和QI認證過程中發現的。 這裡的課題很簡單。透過定期審查提交的認證非常重要,並且可能對貴公司在美國監管機關的地位產生重大影響。這就是為什麼瞭解該系統如何運作,並檢查您的合規計劃實際上是否與您希望的一樣好是如此重要。 在TConsult,我們支援金融機構的法令遵循與合規性,包括QIs。我們可以作為獨立審查員進行定期審查、提交認證,並根據我們對法規的詳細瞭解提供指導和意見。如果您在定期審查或認證方面遇到困難並希望獲得支援,請聯繫我們,我們的專家將很樂意為您提供協助。Read more

Periodic Review Certifications – A Beginners Guide

February 29, 2024After my last article about periodic reviews, a few people asked questions about the types of certifications submitted to the […]Read more

Periodic Reviews – Essential Oversight for QIs

February 27, 2024I just know that a lot of you groaned and put your heads in your hands when you read that […]Read more

定期審查-對QI不可或缺的監管

February 23, 2024我只知道,當您們看到這個標題時,很多人都會痛苦呻吟,並將頭埋入手中。我每天都在和QIs打交道,他們告訴我定期審查是一件多麼令人頭疼的事情,要做好又是多麼具有挑戰性。我想,有不少人都希望不要再處理這些了! 但不管您是否喜歡,如果您在一家涉足美國資本市場的金融機構工作,那麼您的公司完全有可能與美國國稅局簽訂協議,成為QI或稱合格中介機構。這意味著您必須進行定期審查。 QIs與您們的義務 如果您是一家QI,您將簽署一份QI協議。這份長達205頁的文件概述了您作為QI的所有義務,以及美國稅收法第3章和第4章規定的監管義務。以防您實際上沒有閱讀該文件的全部內容,其中大部份義務都與稅務業務、記錄客戶、預扣稅款並向美國財政部繳納稅款以及向美國國稅局報告有關。 然而,合約中還有一個治理部分。許多公司要麼認為這部份並不重要,要麼沒有足夠重視,而這可能會成為他們的禍根。因此,為了讓大家更好地理解,QI協議中的監管內容有: 控制 監管 執行 涵蓋的內容很多,所以今天我們只談第二點–監管。 如果您簽署了一份長達205頁的合約,您就會希望合約中會有一些條款,規定您如何確保簽約方履行他們的義務–以及他們如何知道您履行了您的義務。IRS是使用QI每三年必須進行一次認證的系統來實現這一點。由於QI合約為期6年,因此每個QI在合約期內需要進行兩次認證。每次認證之前都會進行定期審查。 誰進行定期審查? 安排定期審查是責任長官(Responsible Officer)的工作之一。這是您機構中負責監督QI流程的人員,也是身為QI必須履行的控制義務。由於QI義務非常廣泛且複雜,責任長官在做出任何認證之前必須做兩件事: 簽訂合約並監督定期審查 確保您(QI)擁有有效的內部控制 這代表他們必須指派專業人員進行定期審查。IRS對於誰可以進行定期審查有兩項規定。 審查人員必須獨立:QI協議規定,審查人員必須有足夠的獨立性來進行審查,不能審查自己的工作或同一「公司」內其他任何人的工作。因此,如果您讓顧問幫助您進行QI申請或合規計劃,那麼IRS認為他們不是獨立的,不能擔任您的審查人員。我們經常使用我們的Tax Compliance Toolkit平台進行定期審查。 審查人員必須稱職:審查人員需要對QI的帳戶進行測試,以確保他們正確記錄客戶,並確保文檔是有效的、正確地預扣稅款並在FATCA和QI中正確地申報。大多數金融機構的內部審計團隊都很難做到這一點,因為他們往往沒有足夠的美國預扣稅合規知識或經驗。因此,大多數QI需要使用外部審計人員(auditor)或第三方顧問(例如我們)。 […]Read more

1042-S Reporting – A 9-Month Activity You’re Already Behind On

February 14, 2024It’s that time of year again – US 1042-S reporting season! It’s a financial institution’s worst nightmare, and many aren’t […]Read more

Ross is the founder and chairman of TConsult. He has spent over 26 years working in the withholding tax landscape with companies developing tax reclaim software and operating outsource tax reclamation services.

Ross not only sees the big picture but is also incredibly detail oriented. He can make even the most complex issues simple to understand. He has authored 10 books (including two second editions) on various aspects of tax, technology, and regulation in financial services, making him one of the leading authorities in the world of tax.